Real estate investment trusts (REITs) are special real estate companies operating and maintaining commercial and residential properties. REITs are attractive to income investors because they are one of the only types of stocks required to pay out a regular dividend to investors. But did you know that you can also invest in specialized REITs to diversify your passive income streams?

Before you invest in a REIT, consider the sector you’re investing in. Read on to learn more about specialty REITs, how they work and the pros and cons of investing in these real estate operations.

What is a specialty REIT?

Before discussing a specialty REIT and looking at examples, defining a REIT and why these companies differ from other real estate stocks is important. A real estate investment trust (REIT) is a special type of real estate company that purchases and operates commercial real estate or rented residential properties. Most REITs operate relatively straightforwardly, purchasing and maintaining rental properties and collecting tenant income. Some REITs are also involved in mortgage purchasing and home financing.

What sets REITs apart from other companies is their unique tax structure and obligation to distribute a significant portion of their earnings to shareholders as dividends. To qualify as a REIT, a company must meet certain criteria set by the federal government and oversight bodies like the Securities Exchange Commission (SEC).

One of these requirements is that REITs must distribute at least 90% of their taxable income back to shareholders as dividends. These recurring and required dividend payments are one of the REITs’ main appeals, creating a reliable stream of passive income.

As the name suggests, specialty REITs are a subset of REITs that focus on investing in specialized real estate properties and assets. These companies invest in “themed” portfolios of real estate assets within a specific industry or providing a specific type of real estate. Some types of specialty REITs you can invest in include the following:

- Healthcare REITs: Healthcare REITs invest in various healthcare-related properties such as hospitals, medical centers, senior housing facilities, skilled nursing homes and assisted living communities. The demand for these healthcare facilities tends to be relatively stable, driven by the aging population and healthcare needs. It makes them popular for investors looking for a REIT subset with more consistent future product needs.

- Commercial retail REITs: These REITs invest in properties related to retail and commercial spaces, including shopping malls, outlets and standalone retail buildings. Consumer spending trends and the overall health of the retail and consumer discretionary sectors can influence the performance of retail REITs.

- Data center REITs: Data management and cloud computing require large-scale server centers. Data center REITs are a type of specialty REIT that maintains and operates server centers and may also provide internet and cloud computing services to complement customers’ businesses.

Additional types of specialized REITs include office REITs, hospitality and hotel REITs and infrastructure REITs. Like specialized stocks, you can also invest in a specialty REIT ETF that incorporates multiple REITs from within a particular industry or sector into a single investment. These speciality funds provide a quick and convenient way to gain exposure to multiple REITs with a single buy order.

Understanding specialty REITs

Most specialty REITs operate in the same general manner as standard property REITs; these companies purchase property and lease it to tenants, who then make rental payments to the REIT. What differentiates specialty REITs is their focus on a particular real estate market segment. Most of the largest companies in this sector operate as commercial REITs specializing in a sector like healthcare or data centers instead of in residential opportunities like apartment buildings and condos.

Investors seeking diversification may use specialty REITs to introduce specific and targeted exposure to niche segments of the real estate market. For example, if a percentage of your portfolio is devoted to healthcare, you may want to devote a portion of this segment to healthcare REITs. This strategy exposes service providers and the real estate holding groups that maintain and provide commercial space.

The largest sectors within the specialty REIT industry and the major factors influencing them include the following.

Industrial REITs

Industrial REITs make up about 19.24% of the S&P Global REIT, a comprehensive industry benchmark that tracks the performance of publicly traded real estate investment trusts. This makes it the largest segment of the specialty REIT market and has become especially important in the age of e-commerce.

The rise of e-commerce and the dropshipping business model has increased demand for warehouses and distribution centers to facilitate efficient order fulfillment. Industrial REITs positioned in key logistics hubs and equipped to meet the needs of e-commerce companies can experience significant growth. Global trade and manufacturing is another major sector of interest for industrial property investors, with international e-commerce playing a dominant role in future acquisitions.

Retail REITs

Retail REITs are the second largest portion of the S&P Global REIT, making up about 17.89% of the market. These REITs are what more investors think of when they picture commercial real estate, with clients including major shopping centers and standalone retail spaces. While the effects of the COVID-19 pandemic continue to be felt in the retail sector, various retail companies are mitigating the pandemic by high-quality, well-located properties or investing in e-commerce-related real estate that doubles as warehouse or distribution spaces.

Some retailers have begun emphasizing experiential and entertainment-focused offerings to attract consumers to physical stores. For example, Simon Realty Group NYSE: SPG, one of the largest retail REITs in the United States, has recognized the changing landscape of retail and has been actively working to enhance the shopping experience within its malls.

“The Edit” at Roosevelt Field Mall is an example of Simon’s efforts to incorporate experiential elements into its properties, incorporating shifting retail stores, pop-up interactive experiences and outlets to provide a changing shopping experience with more interactive elements.

Data center REITs

Another major portion of the speciality REIT sector, data center REITs make up about 8.12% of the specialty REIT sector. As the growing demand for online services and remote cloud storage grows, more and more opportunities are emerging for investors in this sector. In particular, expanding artificial intelligence and internet-of-things (IoT) services should contribute to increased demand for data center services.

Expanding 5G services also prompts increased growth in the data center and processing industries, resulting in higher profits for data center REITs able to support these functions. The rollout of 5G networks requires robust data center infrastructure to support higher data speeds and connectivity, meaning that not every data center investment aligns with these projects.

Examples of data center REITs expanding services to AI and 5G companies include Equinix NASDAQ: EQIX and Cencora NYSE: COR.

How do specialty REITs work?

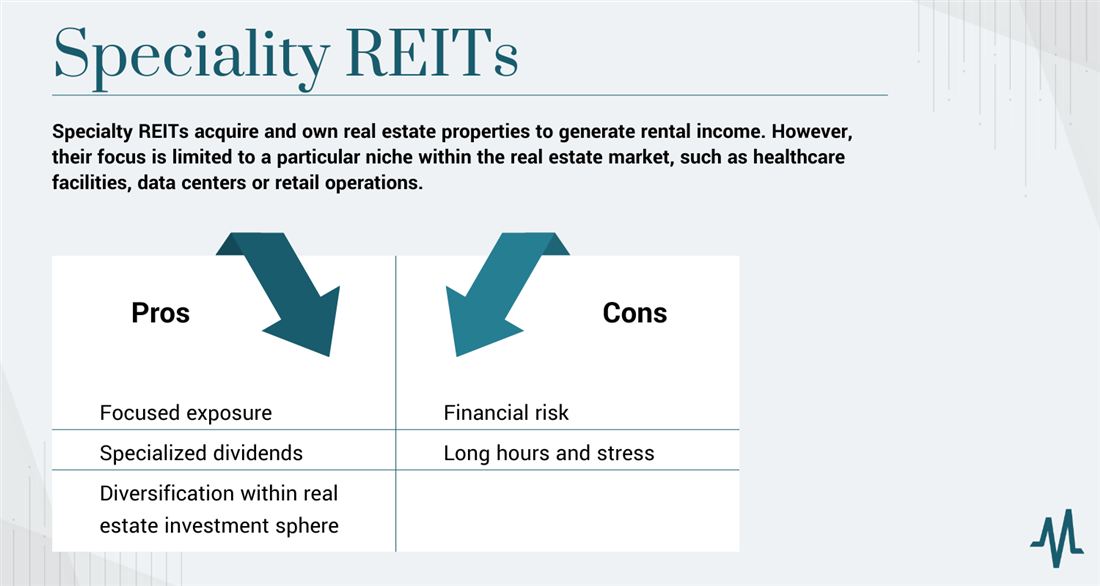

Specialty REITs acquire and own real estate properties to generate rental income like others. However, their focus is limited to a particular niche within the real estate market, such as healthcare facilities, data centers or retail operations.

Specialty REIT managers begin by identifying and scouting new real estate opportunities within the sector they operate. They then use an in-house process to determine investments that qualify for inclusion in their holdings and purchase the properties.

The primary source of income for specialty REITs comes from the rental payments received from tenants using their properties. For example, a healthcare REIT would earn income from healthcare providers leasing medical facilities, while an industrial REIT would generate revenue from warehouse or distribution center tenants. The REIT collects these payments in exchange for maintaining and managing the commercial space, which go to investors as dividends.

How to evaluate specialty REITs for investment

Specialty REITs can provide unique investment opportunities thanks to their structure, potential for high dividend income and exposure to a specific segment within the real estate market. Be sure to consider the following characteristics before choosing which REITs to add to your portfolio:

- Property type and focus: First, look at your current portfolio concentration and decide which industries and property types you’re interested in focusing on. Diversifying your investments across multiple REITs in varying primary industries can be helpful. Interest rates can also play a role in deciding which types of stocks to invest in — periods of high interest rates can increase spending by commercial companies, leading to lower dividend payments.

- Debt levels: Debt levels and interest rates are major considerations before investing in a specialty REIT. When interest rates are high, companies with large unpaid debt balances may see their operating expenses compounded. This could result in lower dividends due to higher expenses incurred operating the physical properties.

- Growth potential: Finally, consider how each company is poised for growth within the REIT industry. Prioritize companies with a solid track record of acquiring and managing properties successfully within the specific realm you’re researching and those with a forward-thinking approach to adapting to market trends. Analyst ratings can affect your decision on which specialty REITs you choose.

How to invest in specialty REITs

Most REIT speciality companies trade on major stock exchanges using the same method as any other share of stock. If you’re interested in buying and selling shares of specialty REITs, use the basic steps below to get started.

Step 1: Select a sector.

The first step to investing in specialty REITs is determining which industry you want to invest in. Consider your overall investment objectives, time horizon and risk tolerance when selecting which types of specialty REITs to include in your portfolio.

Different specialty REIT sectors come with varying levels of risk and potential for returns. For example, healthcare REITs might offer more stability due to essential services, while data center REITs might present higher growth potential and increased volatility.

Consider factors like income potential, current economic conditions and supply/demand dynamics when selecting which specialty industry to focus on. MarketBeat’s list of the top market REITs can help you identify thriving sectors in the REIT industry. You should combine multiple companies within a single sector by investing in a specialty REIT ETF over individual companies to spread your risk out between more operations.

Step 2: Open a brokerage account.

The next step is to open a brokerage account after deciding which specialty REIT sectors you’re interested in investing in. Brokerage accounts are intermediary accounts that connect you with a licensed stockbroker authorized to buy and sell assets on behalf of clients. Most brokers now allow new clients to create a brokerage account from the comfort of their home with an I.D. and link to a funding account.

If you’re a resident of the United States, you have dozens of options when it comes to opening your first brokerage account. Examples of popular brokers include Robinhood, Charles Schwab, E-Trade and T.D. Ameritrade. Some of the factors you might want to consider when selecting a broker can include:

- REIT and market availability

- Types of accounts (taxable brokerage, IRA, self-directed 401(k), etc.)

- Commissions and account fees

- Trading platform and tools

After opening your account, you’ll need to link a funding source before you can buy or sell assets. This may take a few days to confirm fully — use this time to explore market resources and track the items you’re considering buying. After funding your account, you can place a buy order for the shares you’re interested in.

Step 3: Monitor your investment and manage dividends.

If your broker can complete your buy order, you’ll see your shares in your brokerage account. From here, you’ll be responsible for monitoring your shares’ values and deciding how long you want to hold your assets.

You’ll also need to decide how to manage your dividend payments. Most brokers allow you to take your dividends in cash using your linked funding method for deposit, but you can also sign up for a dividend reinvestment program with most assets. When you enable dividend reinvestment, dividends are automatically reinvested in the company that issued them. This can be a more convenient way to grow your holdings over time.

Example of a specialty REIT

A quintessential example of a specialty REIT is data center giant Digital Realty Trust NYSE: DLR. Digital Realty is a global company focusing its investment portfolio on data centers, with operations in South Africa and Greece.

The company sets itself apart from competing data center REITs with its PlatformDIGITALR service, which streamlines customer data processing. Digital Realty Trust has a total market capitalization of $35 billion, making it a major player in the data center REIT arena.

Pros and cons of specialty REITs

Specialty REITs are unique assets, and you’ll need to consider both the pros and cons before investing.

Pros

Specialty REITs allow you to combine an eye toward real estate with a particular sector an investor believes will have a strong future, including:

- Focused exposure: Specialty REITs allow investors to concentrate their exposure in specific real estate sectors, providing targeted exposure to industries with potential growth opportunities. This focused approach can appeal to those strongly convinced about a particular sector’s prospects.

- Specialized dividends: Many specialty REITs focus on sectors with stable demand, such as healthcare facilities, which can lead to consistent rental income. It makes specialty REITs attractive for income-focused investors looking for regular dividends.

- Diversification within the real estate investment sphere: You can diversify your real estate holdings by investing in specialty REITs across different sectors. This diversification can mitigate risk compared to owning individual properties directly.

Cons

REITs’ drawbacks include a heavy concentration in a single sector and the risk of volatility and future dividend cuts:

- Sector-specific risks: Specialty REITs are exposed to the risks inherent to their chosen sectors. For example, regulatory changes may affect healthcare REITs, while retail REITs could face challenges due to shifts in consumer behavior. This can cause concentrated losses if all your specialty REIT investments are in the same sector.

- Lack of diversification: Most specialty REITs invest exclusively in a single sector or area of real estate, which can make them riskier investments due to a lack of diversification.

REIT alternatives

REITs aren’t the only way to invest in real estate. Some common alternatives to REITs might include:

- Investments in real estate-related stocks: REITs aren’t the only stock that deals with real estate. Investing in supplementary companies and sectors can complement REIT investments.

- Crowdfunding: Real estate crowdfunding platforms allow investors to pool their funds to invest in various real estate projects, allowing each investor to see a higher return on investment. This option provides opportunities to invest in specific properties or projects with lower capital requirements when compared to direct personal investments.

- Direct investments: Investing directly in real estate might mean purchasing homes and flipping them or renting these spaces out to tenants. Of course, this investment method provides more direct control but comes with high upfront requirements.

Should you invest in REITs for dividends?

REITs are attractive investment options for those looking to create dividend income streams. While it’s true that REITs show some of the highest dividend yields when compared to other stocks, these high yields may sometimes create a dividend trap for investors, cutting dividends shortly after a stock’s price dips.

Examine dividend history and the number of consecutive years the stock has raised its dividend to ensure you make smart long-term choices.

FAQs

What are specialty REITs, and how do they influence your portfolio? If you have last-minute questions about specialty REITs, the following FAQ will clear them up before you invest.

What is the highest-paying REIT?

The company that pays the highest dividend yield percentage may vary depending on stock price volatility and market changes. Orchid Island Capital NYSE: ORC is one of the largest major REITs with a high dividend. The company maintains a dividend yield of about 18%, higher than competitors.

What are the top five REITs?

Why do investors buy REITs?

There are many reasons why an investor might want to add REITs to their portfolio. These companies are one of the only types required to pay dividends to investors, creating a reliable stream of passive income. These investments also offer a way to gain exposure to the real estate market without the responsibilities of a direct property investment.