Summary:

- You started with an investment of:$ on

- Your principal amount grew to:$ by

- Your total cash withdrawals were: $ over the course of business days

- Your total NET profit for the -day period was: $

Projection breakdown

Download your result

| Day | Date | Earnings | Reinvest | (Principal/Cash Out) | TOTAL Principal | TOTAL Cash |

|---|

Uncover the Power of Compound Daily Interest with Our Advanced Online Calculator

Welcome to the world of financial growth, where understanding compound daily interest can unlock your investment potential. Our online calculator simplifies this concept, turning complex calculations into easy-to-understand results. Whether you’re a seasoned investor or just starting, this tool is designed to enhance your financial planning. Experience the ease of obtaining precise calculations and the convenience of downloading results in PDF or XLS formats.

What is Compound Daily Interest?

Compound Daily Interest is a powerful force in the world of finance. It calculates interest on your principal amount, including previously earned interest, on a daily basis. This means your investment grows faster compared to simple interest, where interest is calculated only on the principal amount. Understanding this concept is crucial for anyone looking to maximize their financial growth.

Benefits of Using Compound Daily Interest

- Accelerated Growth: Interest compounding daily leads to quicker growth of your investment.

- Long-term Gain: Over time, the effect of daily compounding significantly increases your returns.

- Enhanced Savings: Ideal for savings accounts where daily compounding can add substantial value over years.

How Our Online Calculator Makes a Difference

Our user-friendly online calculator is a game-changer. It effortlessly computes complex compound daily interest, presenting results in an easily digestible format. Here’s how it benefits you:

- Accuracy and Efficiency: Eliminates manual calculation errors, providing accurate results quickly.

- Customizable Inputs: Tailor your calculation based on your specific investment parameters.

- Educational Tool: Enhances your understanding of how daily compounding impacts your investments.

Tutorial: Using the Compound Daily Interest Calculator

Using our calculator is straightforward. Enter your principal amount, interest rate, and investment duration. The calculator instantly computes the compound interest. Experiment with different variables to see how changes affect your potential earnings.

Downloadable Results: PDF and XLS Formats

After calculation, you can download the results in PDF or XLS formats. This feature is incredibly beneficial for record-keeping, financial planning, and presenting data in meetings or reports.

Why Choose Our Calculator?

Our calculator stands out due to its accuracy, ease of use, and the option to download results. It’s an indispensable tool for investors, students, and financial enthusiasts.

Understanding Compound Daily Interest is crucial for financial success. Our online calculator is your gateway to mastering this concept, offering precise calculations and downloadable results. Embrace this tool to elevate your financial knowledge and planning.

In the world of finance, one of the most compelling concepts is that of compounding interest. For young investors looking to build wealth over time, understanding and utilizing the power of daily compounding can be a game changer. In this article, we’ll explore what daily compounding interest is, how it can be calculated, and practical examples of how young investors can leverage this concept to grow their investments significantly over time.

What is Compounding Interest?

Compounding interest is the process where the interest earned on an investment is reinvested to generate additional interest over time. Unlike simple interest, where interest is calculated only on the principal amount, compounding interest calculates interest on the initial principal and also on the accumulated interest from previous periods.

The Magic of Daily Compounding

When compounding occurs daily, it means that interest is calculated and added to the investment balance every single day. This frequent compounding results in a higher return compared to monthly or annual compounding due to the constant reinvestment of the interest earned.

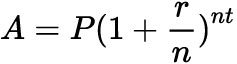

Formula for Daily Compounding Interest

The formula to calculate the future value of an investment with daily compounding interest is:

where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial sum of money).

- r is the annual interest rate (decimal).

- n is the number of times interest is compounded per year (365 for daily).

- t is the time the money is invested for in years.