Compounding Daily Interest Calculator

In the world of finance, one of the most compelling concepts is that of compounding interest. For young investors looking to build wealth over time, understanding and utilizing the power of daily compounding can be a game changer. In this article, we’ll explore what daily compounding interest is, how it can be calculated, and practical examples of how young investors can leverage this concept to grow their investments significantly over time.

What is Compounding Interest?

Compounding interest is the process where the interest earned on an investment is reinvested to generate additional interest over time. Unlike simple interest, where interest is calculated only on the principal amount, compounding interest calculates interest on the initial principal and also on the accumulated interest from previous periods.

The Magic of Daily Compounding

When compounding occurs daily, it means that interest is calculated and added to the investment balance every single day. This frequent compounding results in a higher return compared to monthly or annual compounding due to the constant reinvestment of the interest earned.

Formula for Daily Compounding Interest

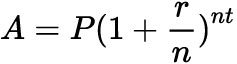

The formula to calculate the future value of an investment with daily compounding interest is:

where:

- A is the amount of money accumulated after n years, including interest.

- P is the principal amount (the initial sum of money).

- r is the annual interest rate (decimal).

- n is the number of times interest is compounded per year (365 for daily).

- t is the time the money is invested for in years.