Key Points

- Nvidia’s stock soared 239% in 2023, greatly outperforming its peers, driven by surging demand for its products.

- Earnings are expected to grow by 66.88% for the year, projecting a substantial increase from $11.08 to $18.49 per share.

- Breaking critical resistance at $500, Nvidia’s recent 14% surge marks a pivotal moment for the stock.

- 5 stocks we like better than NVIDIA

Last year’s hottest stock, Nvidia NASDAQ: NVDA, has begun the new year the same way it ended its previous year. As you most likely know, shares of the chipmaker were up a staggering 239% in 2023, significantly outperforming its tech peers. This was mainly thanks to the surging demand for its products, which saw the company report blowout earnings throughout the year. And just two weeks into the new year, the stock is already up an impressive 10.7% coming into today.

As the above image of the stock’s performance indicates, shares of the semiconductor giant have steadily climbed higher in recent months. Over the past year, the company has experienced staggering gains as the hype and adoption of Artificial Intelligence (AI) grew.

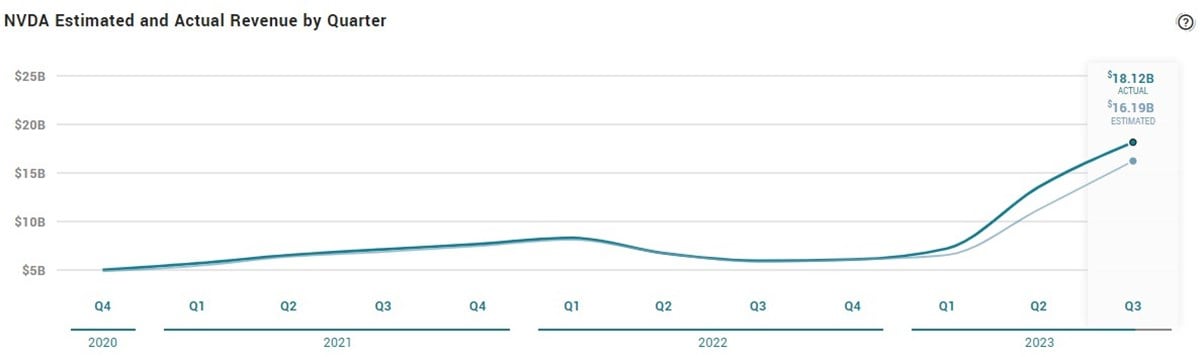

A turning point last year for the stock, its sector, and the overall market was when it reported its first-quarter earnings in May. The boom in AI and the remarkable surge in demand for its chips was reflected as the company topped estimates and left many speechless with its revenue guidance. Nvidia raised its guidance to $11 billion for the second quarter versus analyst expectations of just $7.2 billion. A pattern that repeated in the quarters to follow.

During the second quarter, the company experienced a remarkable 101% year-over-year revenue increase, reaching $13.5 billion, surpassing its projected guidance. Additionally, net income witnessed a remarkable surge of over 800%, reaching $6.2 billion.

The company’s performance was even more noteworthy in the third quarter, with revenue tripling to $18.1 billion. Net income also exhibited substantial growth, reaching $9.2 billion, marking an increase of more than 13 times compared to the previous year.

The remarkable growth is set to continue for the company, with earnings expected to grow by 66.88% in the year, from $11.08 to $18.49 per share. All eyes will be on the company’s next earnings release, which is set to come out on Wednesday, February 28.

Analysts remain bullish, forecasting further upside

Nvidia, part of the Magnificent Seven and currently the fourth-largest holding in the SPDR S&P 500 ETF NYSE: SPY, has solidified its supremacy and impact within its sector, the broader market, and among its esteemed trillion-dollar-plus market capitalization tech counterparts.

The consensus among investors aligns with analysts, as evidenced by a Moderate Buy rating derived from thirty-eight analyst evaluations. Nvidia stands out as one of the most extensively tracked and frequently searched stocks and featured stocks on the Top-Rated list, receiving significant upgrades from analysts.

Despite its remarkable performance last year, and already surging almost 11% this year, the consensus analyst price target sees over 8% upside for the stock. With earnings quickly approaching, its consensus price target and ratings will likely experience notable changes.

The stock just broke above a critical level

After trading within the $500 to $450 range for several months, the stock made a significant breakthrough, surpassing the critical resistance at $500 on Monday, resulting in a remarkable surge of over 14%. This marks a pivotal moment for the company’s stock. However, despite showcasing considerable strength, there’s a short-term concern as the stock now holds an RSI of 73.38, indicating a potential overbought condition.

For traders and investors focusing on technical analysis, observing a pullback above the $500 breakout level might be prudent, confirming a higher low. This confirmation could signal the initiation of a sustainable uptrend.

Should you invest in NVDA?

The persistent scarcity of Nvidia’s products and the evident technological edge over competitors paint a positive outlook for the stock. Surprisingly, despite its current P/E of 72.39, shares appear reasonably priced with a forward P/E of 27. Considering these factors and its explosive recent breakout, the AI stock appears promising for potential upward movement throughout 2024.

Before you consider NVIDIA, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and NVIDIA wasn’t on the list.

While NVIDIA currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat’s analysts have just released their top five short plays for January 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report