Summary:

- You started with an investment of:$ on

- Your principal amount grew to:$ by

- Your total cash withdrawals were: $ over the course of business days

- Your total NET profit for the -day period was: $

Projection breakdown

Download your result

| Day | Date | Earnings | Reinvest | (Principal/Cash Out) | TOTAL Principal | TOTAL Cash |

|---|

Table of Contents

Unveiling the Power of Daily Compound Interest: Your Guide to Exponential Wealth Growth

Welcome to the world of financial empowerment with daily compound interest – a key to unlocking exponential wealth growth. Our comprehensive guide and cutting-edge calculator are designed to demystify this crucial financial concept, helping you harness its potential for your investment journey. Dive into the mechanics of daily compounding and explore how it can significantly impact your long-term financial goals.

Understanding Daily Compound Interest

Daily compound interest, a cornerstone in the realm of finance, is the process where interest is calculated on a daily basis, not only on your initial investment but also on the accrued interest from previous days. This method can dramatically increase your investment over time, more so than monthly or yearly compounding, due to the frequent application of interest.

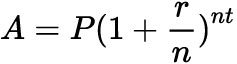

The Daily Compound Interest Formula

At the heart of understanding daily compound interest is its formula:

Where:

- A = the future value of the investment/loan, including interest

- P = principal amount

- r = annual interest rate (decimal)

- n = number of times interest is compounded per year

- t = time the money is invested or borrowed for, in years

This formula is instrumental in calculating how your investment will grow over time, considering the daily compounding factor.

Real-World Examples and Scenarios

Illustrate with examples: For instance, if you invest $1,000 at an annual interest rate of 5%, compounded daily, the future value of your investment over different periods (5 years, 10 years, 20 years) showcases the significant impact of daily compounding.

Benefits of Daily Compound Interest

Delve into the benefits of daily compound interest, such as the rapid growth of investments and the advantage of earning interest on interest. This compound effect becomes more pronounced over longer periods, making it a powerful tool for achieving long-term financial objectives like retirement savings or educational funds.

Using Our Online Daily Compound Interest Calculator

Highlight the features of your online calculator: its ease of use, customizable inputs (principal amount, interest rate, investment duration), and the ability to immediately visualize the potential growth of your investments. Emphasize the calculator’s practicality for various financial planning scenarios, from saving for a down payment on a house to building a retirement corpus.

Strategies for Maximizing Wealth with Daily Compound Interest

Share strategies for maximizing returns, such as starting early to leverage the power of compounding over time, regularly contributing to investment accounts, and maintaining a diversified investment portfolio to balance risk and return.

Conclude by reaffirming the transformative potential of daily compound interest in wealth accumulation. Encourage readers to utilize your online calculator to explore and plan their financial future, emphasizing the calculator’s role in making informed investment decisions.